us japan tax treaty interest withholding

The main points of the amendments to the Japan-US tax treaty. Emphasis is placed on corporate tax structures.

Japan United States International Income Tax Treaty Explained

The US Japan tax treaty eliminates withholding taxes on dividends paid by a Japanese subsidiary to its US parent if the parent has owned 50 or more of the subsidiarys voting stock.

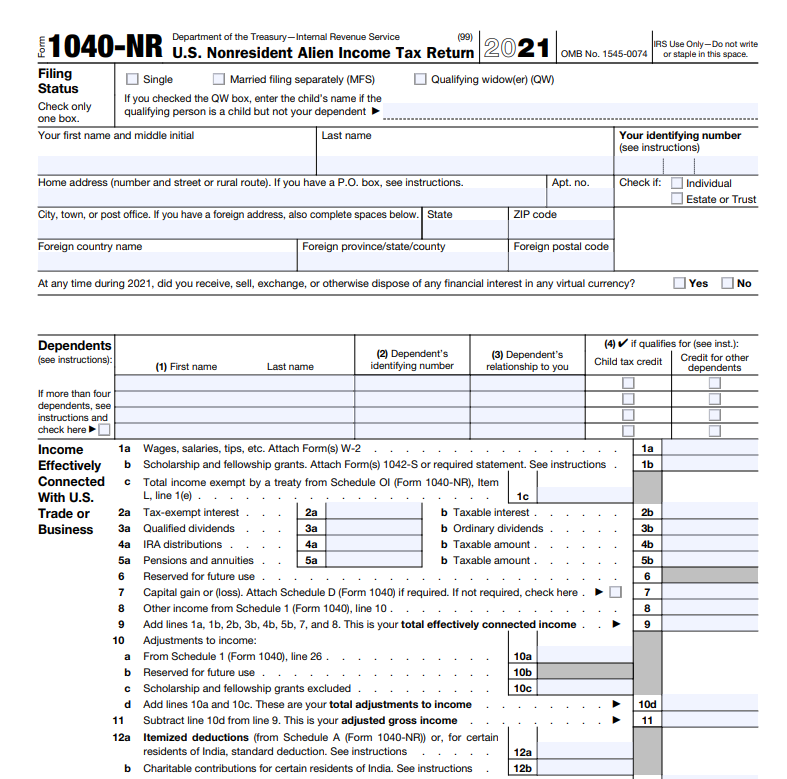

. United States and the foreign country and the individual does not waive the benefits of such treaty. Tax Rates on Income Other Than Personal Service Income Under Chapter 3 Internal Revenue Code and Income Tax Treaties Rev. 1 January 2019 for taxes withheld at source on amounts paid or credited to non- residents.

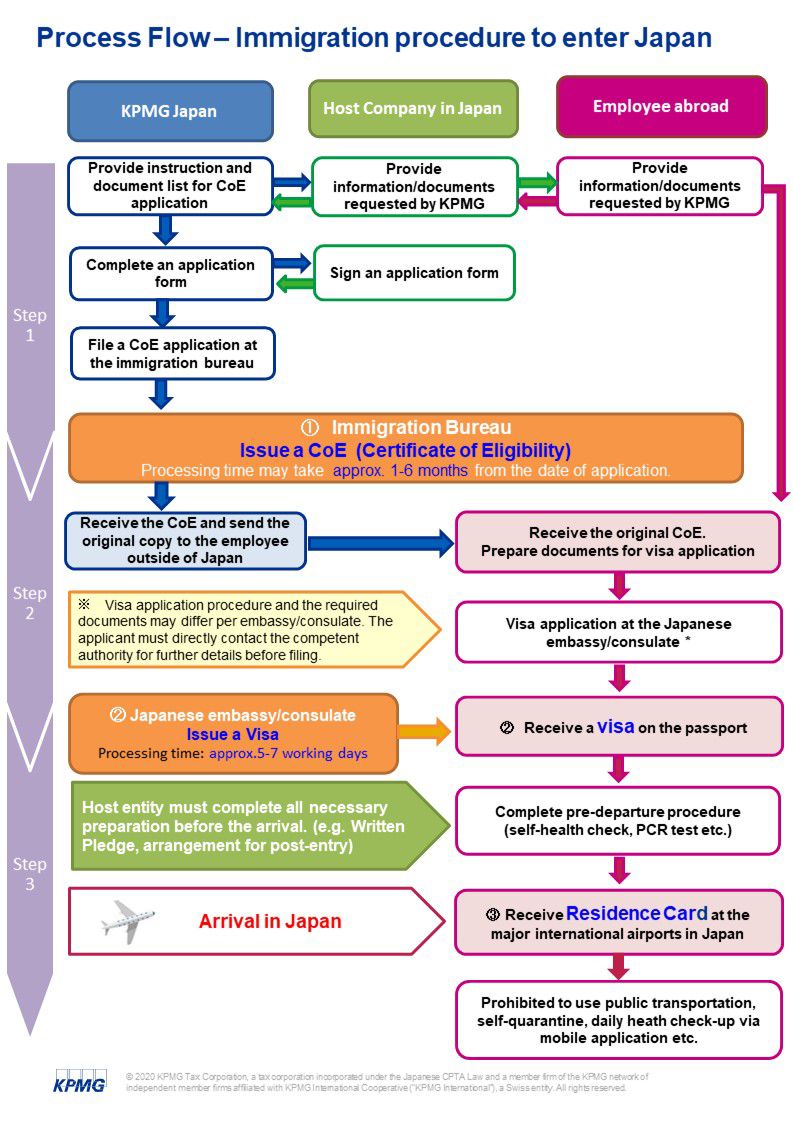

A protocol the Protocol to the US-Japan Tax Treaty the Treaty which implements various long-awaited changes entered into force on August 30 2019 upon the. 1 April 2020 for Corporation Tax. Under US domestic tax laws a foreign person generally is subject to 30 US tax on the gross amount of.

In an effort to strengthen the bilateral economic relationship and promote cross-border investment Japan and the US signed a protocol to amend the 2003 income tax treaty between. For definition of large holders. United States of America 0 1 10 0 2 0 2 1.

Requirements to obtain exemption from withholding tax on dividends from subsidiaries will be. Article 11 of the United States- Japan. 5 Article 5 Permanent Establishment in the Japan-US Income Tax.

This article discusses the implications of the United States- Japan Income Tax Treaty. The protocol is the second to amend the treaty and. Large holders of a REIT are not exempt 15315.

Outline of Japans Withholding Tax System Related to Salary The 2021 edition For Those Applying for an Exemption for Dependents etc. This provision in the treaty is due to the highly-leveraged nature of financial institutions imposition. Last reviewed - 01 August 2022.

Pension funds are exempt under certain conditions. Japan Inbound Tax Legal Newsletter August 2019 No. 6 April 2020 for Income Tax and Capital Gains Tax.

1 US Japan Tax Treaty. 30 August 2019. This table lists the income tax and.

Japan-US Tax Treaty 2013 protocol entered into force on 30 August 2019 the date Japan and the US exchanged instruments of. This section discusses the aspects of Japans tax system that are most relevant to a foreign corporation or individual investing in Japan. With Regard to Non-resident Relatives.

Any foreign entity other than a foreign financial institution. 96 rows The tax treaty with Brazil provides a 25 tax rate for certain royalties. All groups and messages.

2 Saving Clause in the Japan-US Tax Treaty. Refund excess tax withheld. 4 Saving Clause Exemptions.

62 rows Corporate - Withholding taxes. All groups and messages. The US Japan tax treaty eliminates withholding taxes on dividends paid by a Japanese subsidiary to its US parent if the.

Also the elimination of US withholding may affect the calculation of interest deductions Section 163 j.

No 12007 Foreign Tax Credit For Residents National Tax Agency Japan

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

Japan United States International Income Tax Treaty Explained

Portfolio Interest Exemption Us Htj Tax

Insight Impact Of Mli On Deals India Perspective

Japan Us Tax Treaty 2013 Protocol Entry Into Force Business Tax Deloitte Japan

Dentons Global Tax Guide To Doing Business In Ecuador

Japan Taxation Of International Executives Kpmg Global

Trump Signs International Tax Treaties Wealth Management

When To Consider A Protective 1120 F Filing Expat Tax Professionals

The Complete J1 Student Guide To Tax In The Us

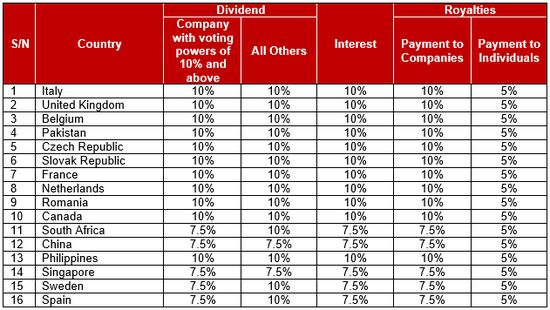

Minister Of Finance Approves Increase In Withholding Tax Rates Under Double Taxation Agreements Between Nigeria And Other Countries With Effect From 1 July 2022 Withholding Tax Nigeria

Japan Tax Reform 2016 Japan Industry News

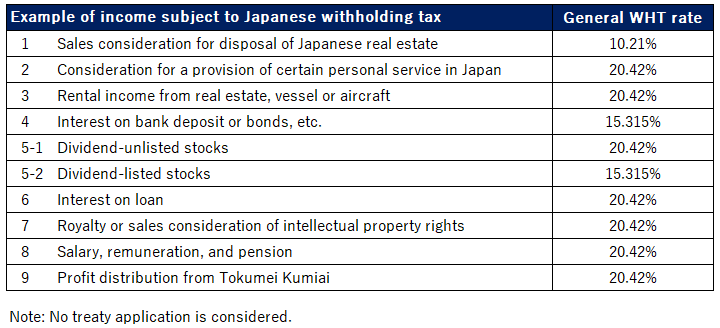

Japanese Withholding Tax Imposed On Non Resident Suga Professional Tax Services

Japan Us Tax Treaty 2013 Protocol Entry Into Force Business Tax Deloitte Japan

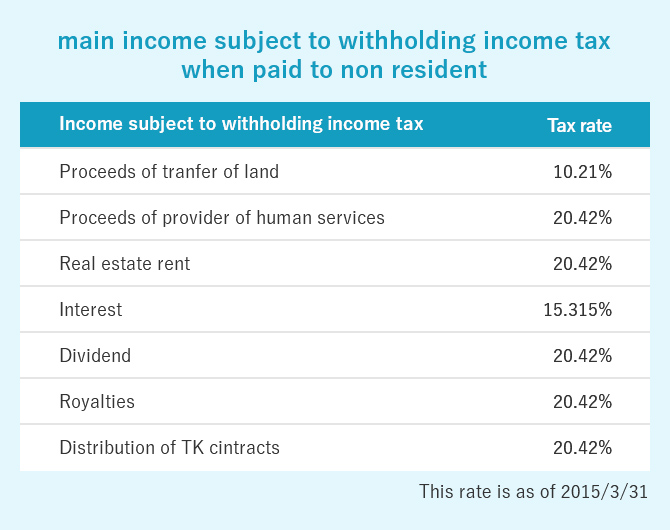

Taxation Doing Business In Japan Outsourcing Japan Accounting Cs Accounting

United States Taxation Of International Executives Kpmg Global

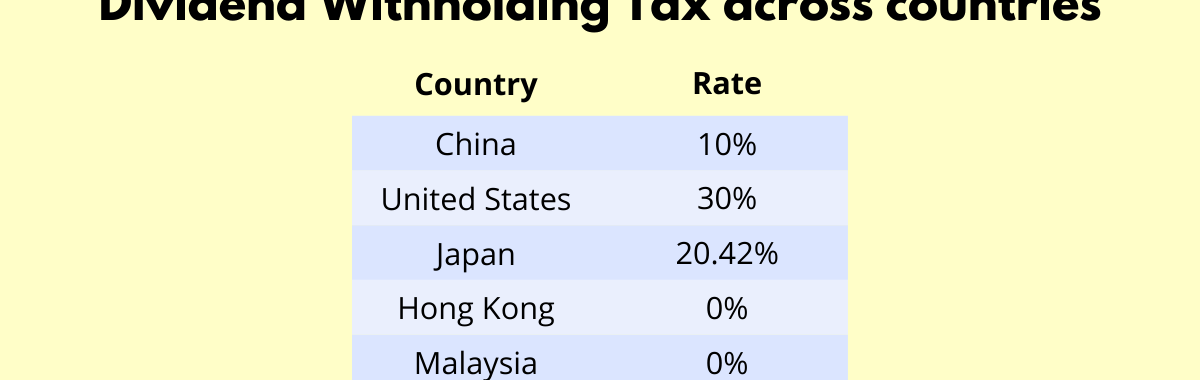

U S Dividend Withholding Tax What Singapore Investors Must Know